Leverage

What is Leverage?

Leverage is a powerful tool for traders to help you expand your exposure to financial markets and maximize capital when you invest less.

Principle of Leverage Trading

Through leverage, you can borrow a loan from the dealer, significantly reducing the amount of capital you need to invest in a transaction.

Before you start trading, you need to prepare an initial margin, which is the deposit required when opening a position. When the number of positions remains the same, the greater the leverage used, the less the used margin occupied by each exchange, and the free margin increases, helping you to compete against greater risks.

If your trade starts to lose money, you will receive a margin call and you need to inject more funds to maintain the opening position. These additional funds are called maintenance margin.

Benefits of Using Leverage

Maximize Profits

Win big gains with small capital and achieve double-fold returns

Leverage Opportunities

Use the released funds to invest more and improve the efficiency of capital utilization

Shorting

Not only can you use leverage when the price rises, but you can also short sell when the price falls

24-Hour Trading

Trading around the clock in major indices and the forex market to seize every trading opportunity

1:1000

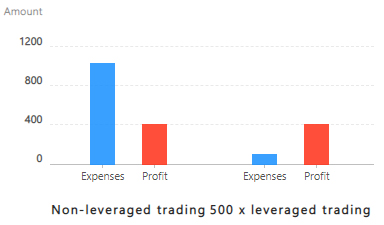

You can flexibly choose up to 1000 times leverage in Doo Prime! No need to invest in all the funds, only use the margin to open a position, and get more potential lucrative profits than non-leveraged trading.

All of the above are CFD trading products. Kindly read the following Risk Disclosure for High Risk Trading Products:

Leverage Ratio and Margin Trading

Leverage Ratio is an indicator that measures the ratio of trading exposure to margin requirements, depending on the market you are trading, trading instruments, and position size.

In non-leveraged trading, 1 yuan can only buy assets equivalent to 1 yuan, while in leveraged investing, 1 yuan can buy assets worth more than 1 yuan. For instance, when the leverage ratio is 200 times, you can buy assets worth 200 yuan for 1 yuan, and so on, and your investment income or loss will expand with that ratio.

For instance: If you choose to trade with an exposure size of USD100,000 with 200 times leverage in Doo Prime, you only need to invest 500 yuan in margin to open a position.

The calculation is as follow: US$100,000 * (1/200) = US$500

On Doo Prime’s MT4 and MT5 platforms, you can determine the maximum leverage available by viewing the margin ratio of each trading symbol.

For instance: If the margin ratio of a trading symbol is 2%, it means that you can use up to 50 times leverage (1/0.02=50).

One Click to Invest Globally

At Doo Prime, you can invest in Securities, Futures, Forex, Precious Metals, Commodities and Stock Indices with just one integrated account. Indulge in trading over 10,000 financial products at a glance, easily accessing 6 major markets and seize every global opportunity.

Start Your Trading Journey with 4 Easy Steps

01

Register

Click on “Register” and enter your details to sign up.

02

Verify

Complete the verification process and your account will be activated immediately.

03

Deposit

Deposit funds via our fast and secure payment gateways.

04

Trading

Kickstart your first global trading journey.

At Doo Prime, you can invest in Securities, Futures, Forex, Precious Metals, Commodities and Stock Indices with just one integrated account. Indulge in trading over 10,000 financial products at a glance, easily accessing 6 major markets and seize every global opportunity.